capital gains tax proposal reddit

Fears voiced about valuations productivity and property slumps. Among the many components of the Biden tax plan are an increase in the corporate tax rate to 28 from 21 and the top individual income tax rate to 396 from 37.

Reddit Ipo What You Need To Know Forbes Advisor

Wise long term investment is driven by strong profits which are caused by strong demand for products and services.

. I plan to sell it early next year once its fully booked for summer 2023 the property will gross 70000 this year. First the bill states that this is a capital gains tax so its on sales of assets that. The proposal would levy a 7 tax on the sale of things like stocks bonds and other assets above 250000 for individual and joint filers excluding the sale of all real estate and carving out an exception for qualified family-owned small businesses.

Prices here have gone insane. Read this on the new capital gains tax proposal on page 61. 1 day agoA package of tax increases lower drug prices and other provisions aimed at reducing the federal budget deficit could alleviate rapid price gains.

Ill start out with my general hypothesis. I have found conflicting info on whether I would owe 20 or 25 capital gains tax as it is an investment property. Id like to sell the rest of our stock soon but am worried about the potential consequences especially since if I needed to I could sell some.

Read customer reviews find best sellers. Press question mark to learn the rest of the keyboard shortcuts. The total tax rate on capital gains and dividends for the wealthiest Americans would rise from 238 to 434.

Capital Gains Tax question. Free easy returns on millions of items. The wealthy also own the majority of stocks so it still affects the market.

We bought the house we have lived in for the last 3 years for very cheap. 1 day agoThe Inflation Reduction Act of 2022 bill includes changes to Section 1061 of the Codechanges for real estate operators and investors is the Section 1231 gains will now be subject to a three-year. I see that theyre saying now that anyone making over a million would see capital gains taxes go up to about 40 and then state taxes on top of that.

It kicks in above 501600 for married couples filing a joint tax return. This is kind of an accounting question but it has to do with us getting out of debt and skipping ahead 2 to 3 years in our 5 year plan. The proposed capital gains increase will only be for 1MM in cap gains each year.

Press J to jump to the feed. In other words they want to tax anybody that gain over 1000000 37 in which it will help prevent economy disparities among Americans preventing a market crash. This does not include the 38 levy on net investment income.

And thats just federal taxes. Tack on state taxes and the total tax. Get Access to the Largest Online Library of Legal Forms for Any State.

Not to get political in a crypto sub but this will never get the 50 votes to. How to avoid capital gains tax on stocks reddit. The top rate would be 288.

The AFP proposes eliminating the step-up on gains over 1 million. The IRS also charges high-income investors an additional 38 net investment income tax which could raise Bidens proposed tax to 434 for those with long-term capital gains over 1 million. Higher taxes on capital.

Low capital gains taxes only serve to increase the potential profits of speculation and do little to add capital investment into the. Combining Bidens proposed capital gains tax with the existing estate tax law which says that if you die with over 117 million in assets that amount is taxed once at a 40 rate some wealthy. Our tax filings is normally just our salaries.

Free shipping on qualified orders. President Bidens Fiscal Year 2023 budget calls for imposing an annual 20 percent tax on taxpayers with income and assets that exceed 100 million a. Capital Gains tax proposal buying opportunity.

The Biden plan would also keep the Medicare surtax in place creating a top long-term capital-gains rate of 434 according to Bloomberg. 2 days agoThe proposal called the billionaires minimum income tax would require that taxpayers worth more than 100 million pay a minimum of 20 on their capital gains each year regardless of whether. My wife and I are in the 0 tax bracket this year I havent worked and my wife gets tax free retirement.

Posted on July 3 2022 by. Ad The Leading Online Publisher of National and State-specific Legal Documents. Biden recently announced they are proposing raising the capital gains to 396 to those who make over 1 million.

The top long-term capital-gains rate applies to single taxpayers with more than 445850 of income this year. The Tax Working Group TWG has suggested that a broad tax on capital gains might raise 290 million in its first year rising to 27b in 2026 and just under 6b in 2031. With this new plan that rate will increase to a whopping 396--nearly double what they are paying now.

Im wondering if theres any chance this will affect the 2021 tax year. As it stands right now those in the high-income tax rate currently see only a 20 capital gains tax on certain assets. The property is worth 750000.

Its long-term capital gains. Only people who make over 400k a yr will be affected by the new tax laws corporations. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee.

The first 1 million in gains would still be passed on to heirs tax-free Bottom line. The tax is being raised so capital gains pay same as wages. For the dad and daughter it would set the basis at 200 so that if the daughter immediately sold the asset for 1000 there would be capital gains tax.

Ad Browse discover thousands of brands. But it acknowledges.

Guy I Know Misunderstood The 50 Capital Gains Tax And Is Convinced The Government Will Literally Take 50 Of His Realized Capital Gains If He Sells R Personalfinancecanada

Easy Way To Calculate Capital Gains Tax On Drip Shares

Capital Gains Tax Is Stupid R Bitcoin

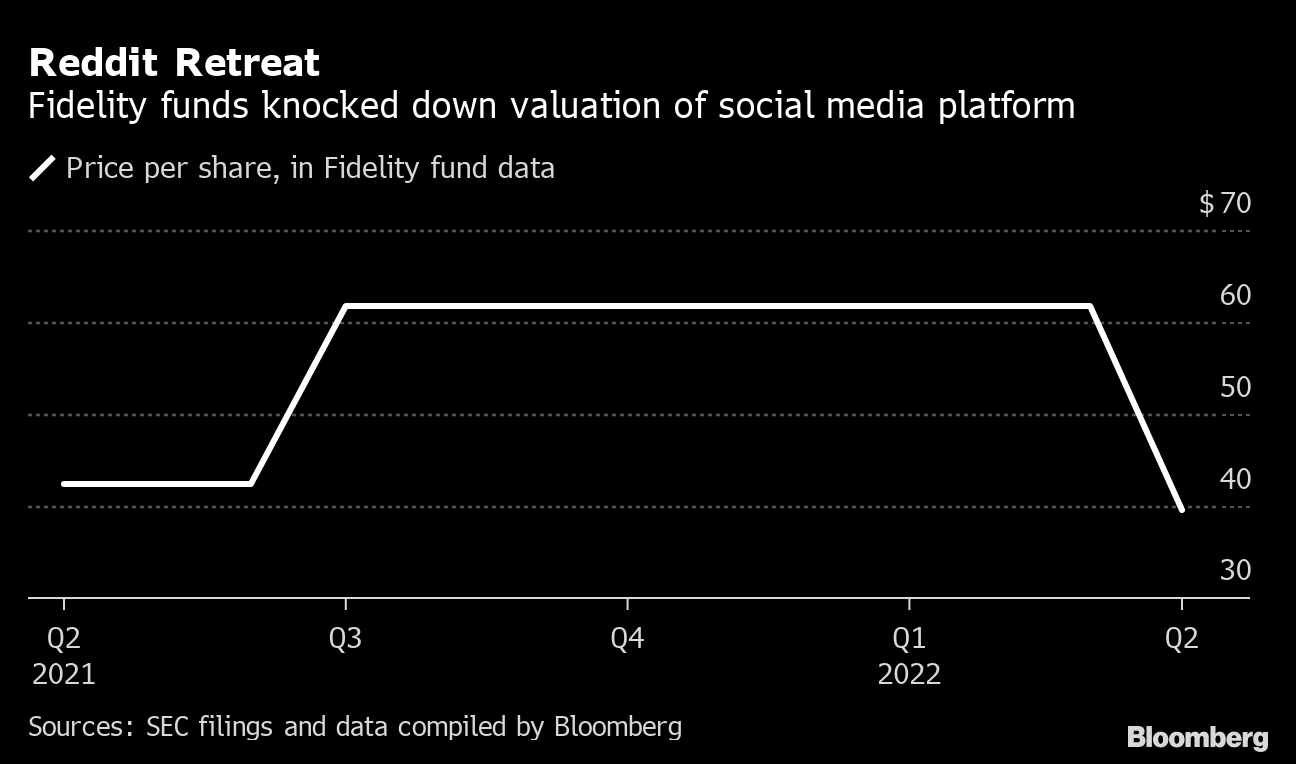

Fidelity Slashes Reddit Stripe Valuations After Tech Rout Bloomberg

How Advisors Are Tapping Into Tiktok And Reddit Putnam Investments

Reddit Is Raising Up To 700m In Series F Funding Techcrunch

How Advisors Are Tapping Into Tiktok And Reddit Putnam Investments

75 Capital Gains Tax Promised To Canadians By Ndp R Canadianinvestor

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Top Reddit Penny Stocks To Watch Now Timothy Sykes

![]()

What S Your Thoughts On High Income Tax R Personalfinancecanada

Crypto Currency A Guide To Common Tax Situations R Personalfinance

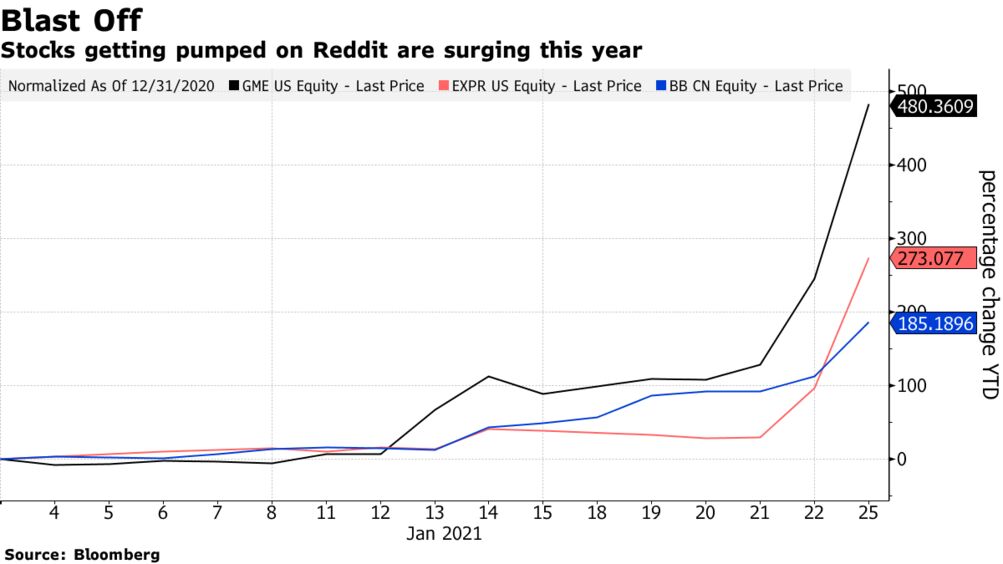

Reddit Picks Express Expr Gamestop Gme Blackberry Bb Stocks Surge Bloomberg

Percent Of People Born In Us State Or Eu Country In Which They Currently Live In 2019 Data Example This Means That 27 Of People Living In Nevada Were Born In Nevada

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Here S Why Actually The Irs 600 Bank Reporting Proposal Is Entirely Reasonable

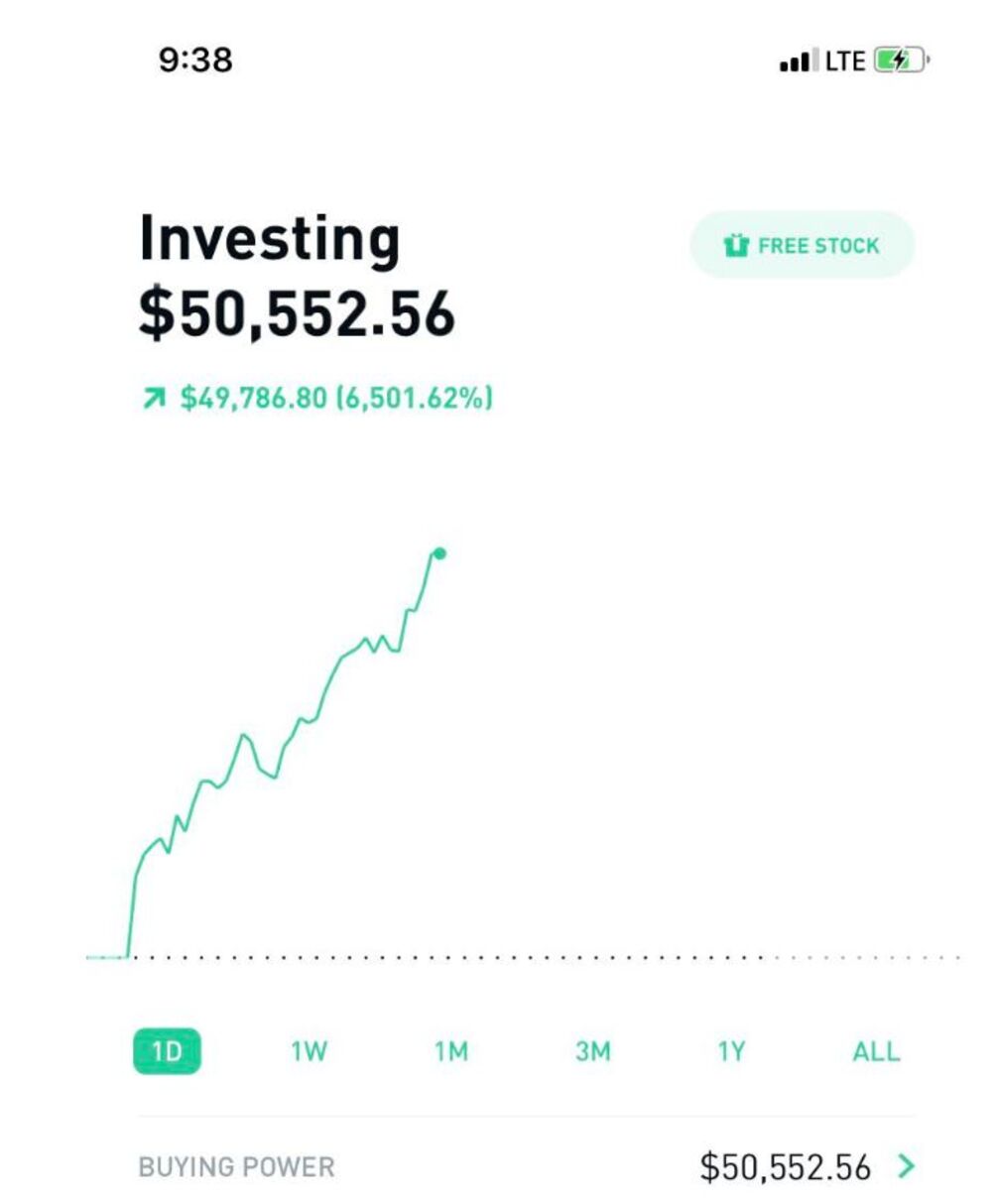

Reddit Investing Tips Online Trader Turns 766 Into 107 758 Bloomberg